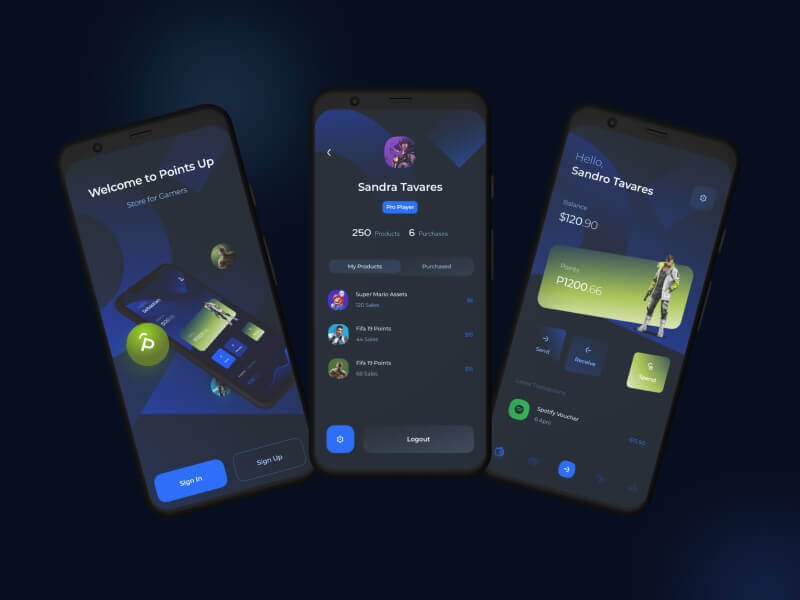

NFT Dashboard Application Development.

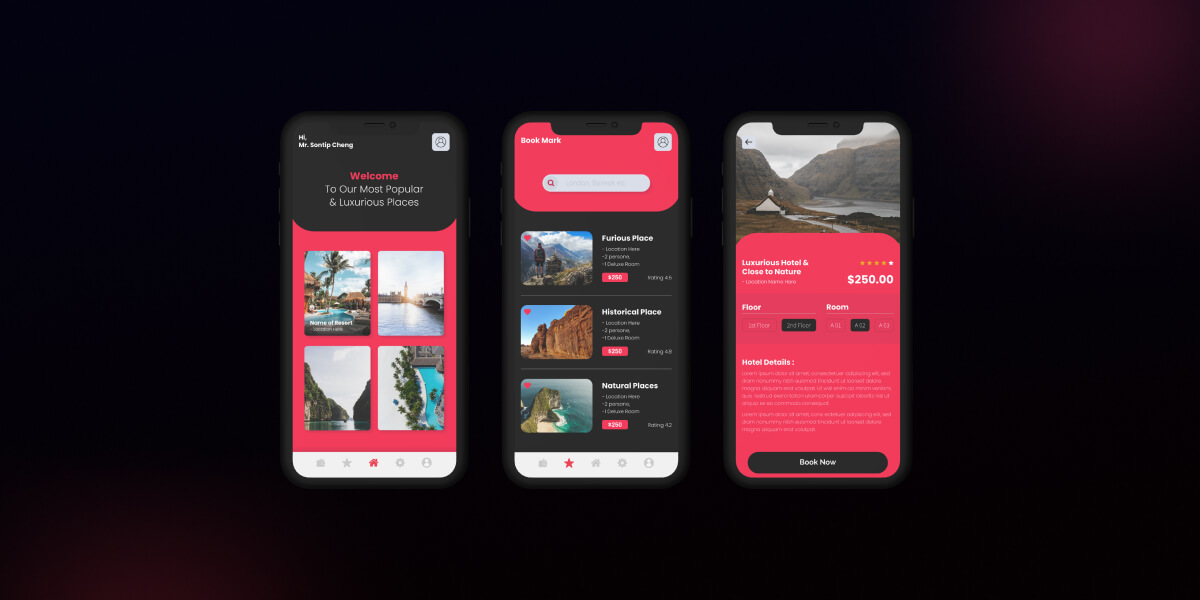

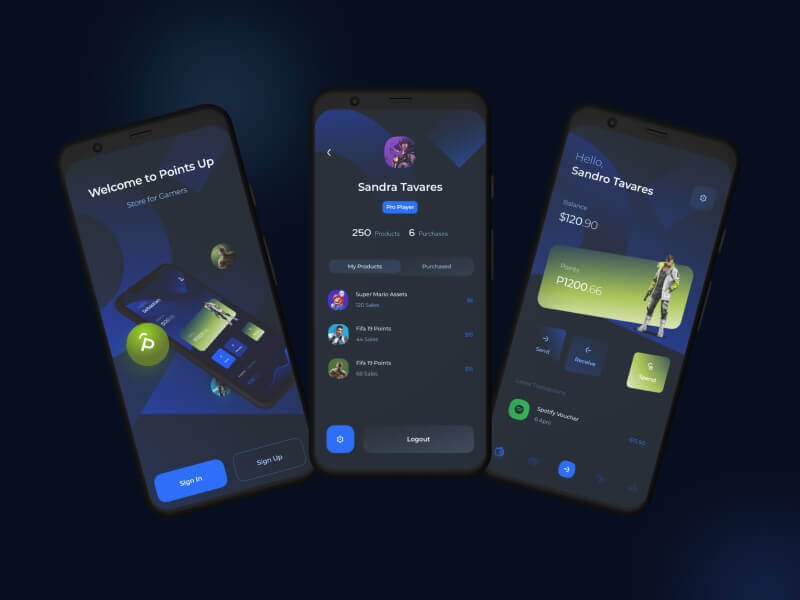

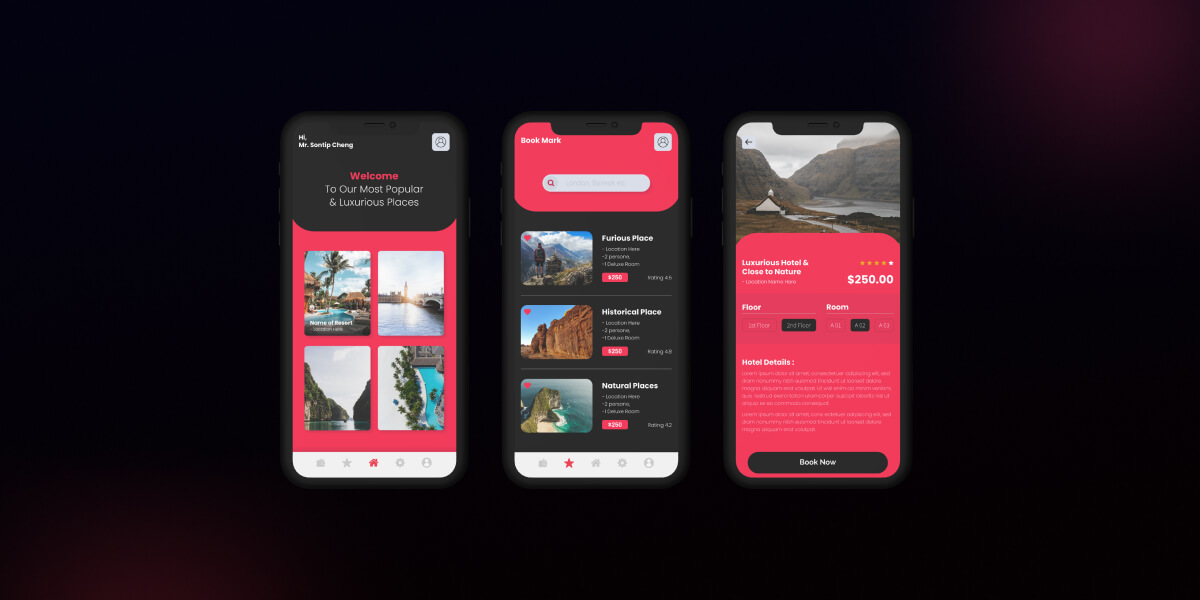

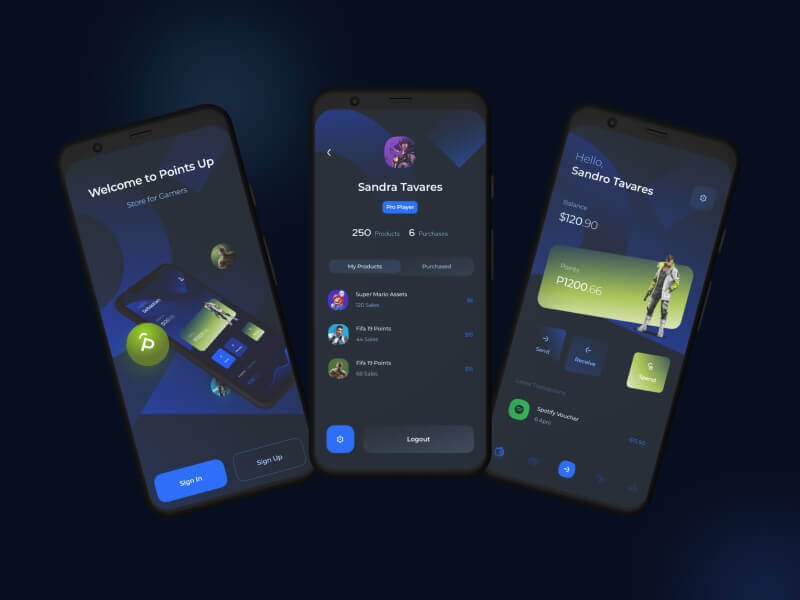

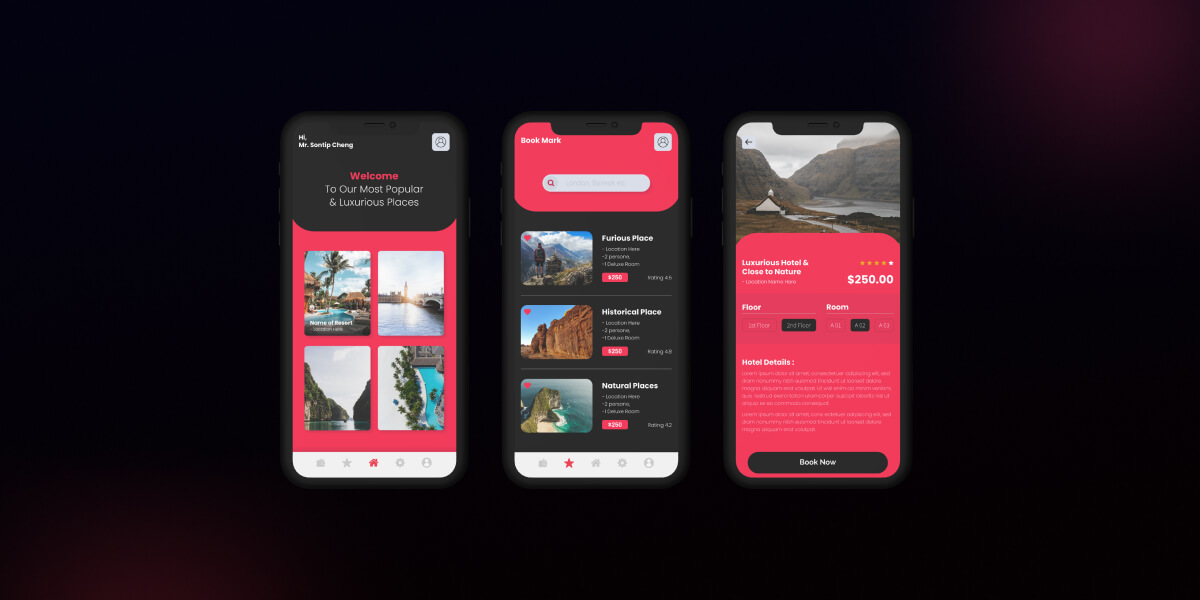

Through a wide variety of mobile applications, we’ve developed a unique visual system.

- Client George Wallace

- Date 15 June 2022

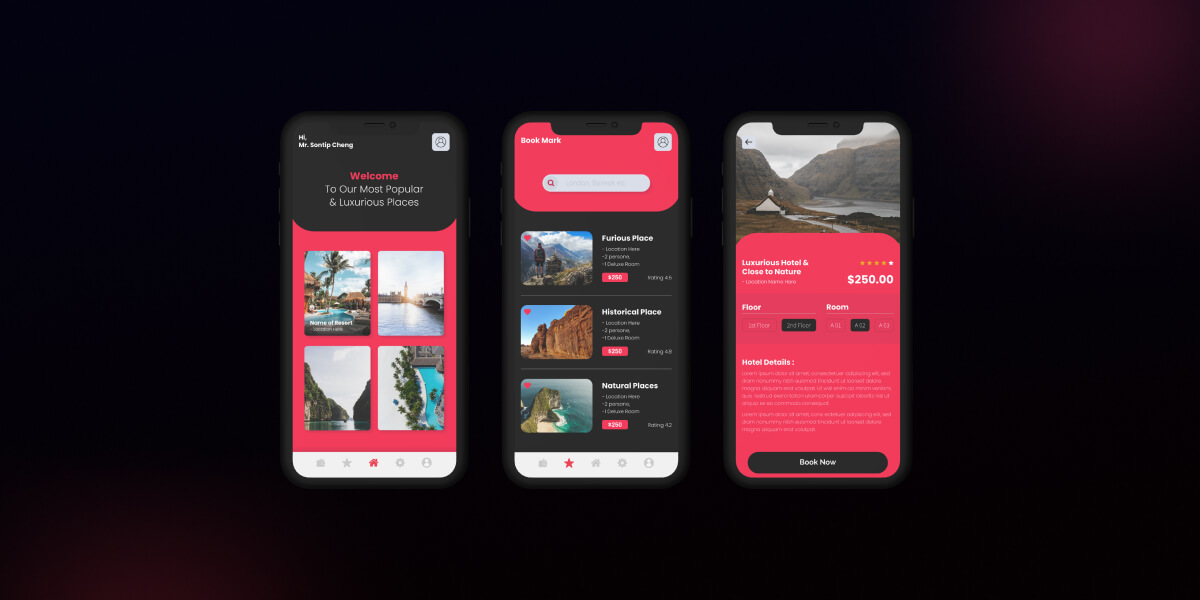

- Services Web Application

- Budget $100000+

Hi, I’m Patrick Ngugi, a photographer based in Nairobi with a passion for storytelling that makes an impact. My work focuses on news and climate change photography—capturing the moments that matter, the stories that need to be told, and the realities that shape our world. Through my lens, I bring to light the human side of global challenges, whether it’s covering breaking news or documenting the effects of climate change on communities here in Kenya and beyond. I believe that a single image has the power to inform, inspire, and move people to action. Working with media outlets, NGOs, and other organizations, I aim to create visuals that resonate deeply and foster change. If you’re looking for powerful, story-driven photography, I’d love to explore how my work can help bring your vision to life. Feel free to take a look at my portfolio to see the world as I see it—or reach out if you’d like to connect!

I throw myself down among the tall grass by the stream as Ilie close to the earth.

I throw myself down among the tall grass by the stream as Ilie close to the earth.

Through a wide variety of mobile applications, we’ve developed a unique visual system.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

A strategy is a general plan to achieve one or more long-term. labore et dolore magna aliqua.

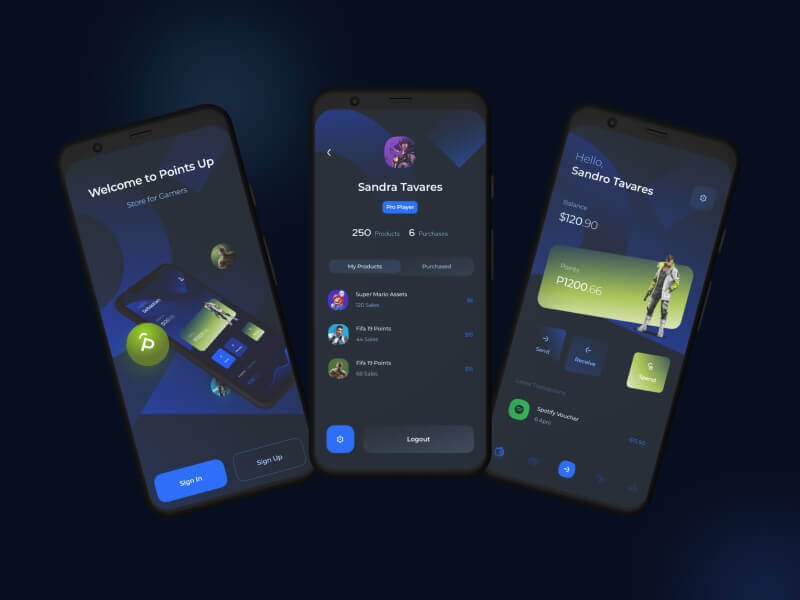

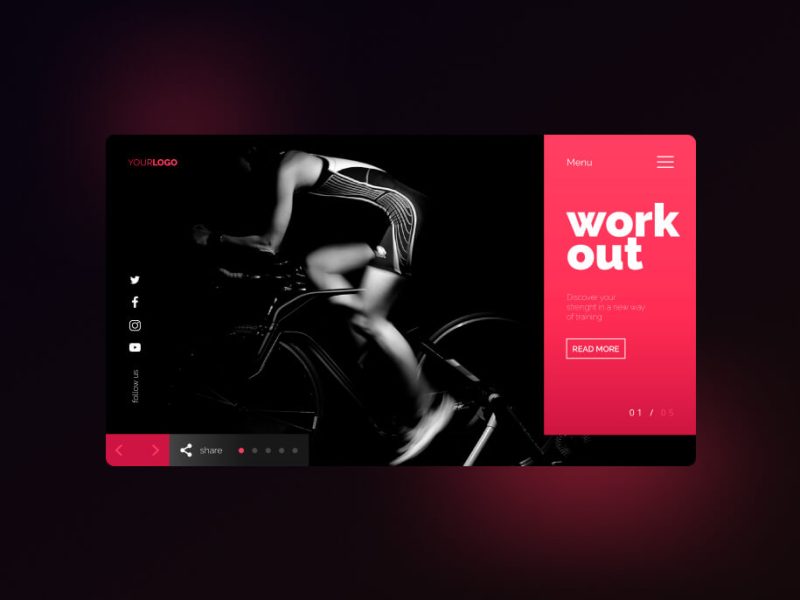

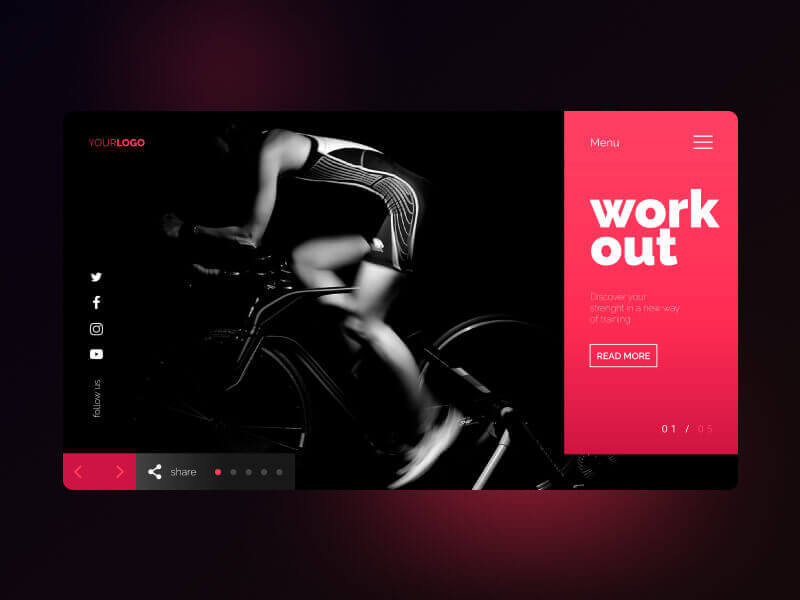

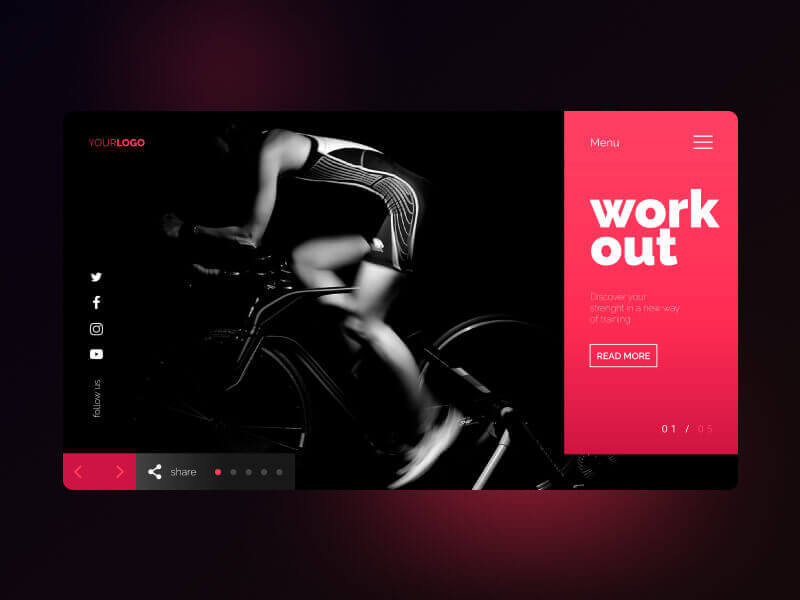

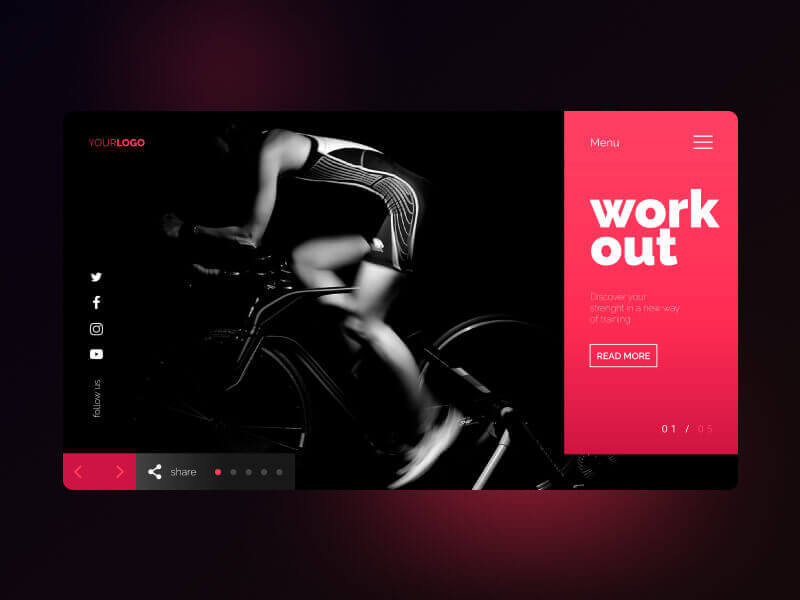

UI/UX Design, Art Direction, A design is a plan or specification for art. which illusively scale lofty heights.

User experience (UX) design is the process design teams use to create products that provide.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications.

UI/UX Design, Art Direction, A design is a plan or specification for art viverra maecenas accumsan.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

The training provided by universities in order to prepare people to work in various sectors of the economy or areas of culture.

Higher education is tertiary education leading to award of an academic degree. Higher education, also called post-secondary education.

Secondary education or post-primary education covers two phases on the International Standard Classification of Education scale.

Google’s hiring process is an important part of our culture. Googlers care deeply about their teams and the people who make them up.

A popular destination with a growing number of highly qualified homegrown graduates, it's true that securing a role in Malaysia isn't easy.

The India economy has grown strongly over recent years, having transformed itself from a producer and innovation-based economy.

Google’s hiring process is an important part of our culture. Googlers care deeply about their teams and the people who make them up.

A popular destination with a growing number of highly qualified homegrown graduates, it's true that securing a role in Malaysia isn't easy.

The India economy has grown strongly over recent years, having transformed itself from a producer and innovation-based economy.

The training provided by universities in order to prepare people to work in various sectors of the economy or areas of culture.

Higher education is tertiary education leading to award of an academic degree. Higher education, also called post-secondary education.

Secondary education or post-primary education covers two phases on the International Standard Classification of Education scale.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary

1 Page with Elementor

Design Customization

Responsive Design

Content Upload

Design Customization

2 Plugins/Extensions

Multipage Elementor

Design Figma

MAintaine Design

Content Upload

Design With XD

8 Plugins/Extensions

All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary

5 Page with Elementor

Design Customization

Responsive Design

Content Upload

Design Customization

5 Plugins/Extensions

Multipage Elementor

Design Figma

MAintaine Design

Content Upload

Design With XD

50 Plugins/Extensions

All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary

10 Page with Elementor

Design Customization

Responsive Design

Content Upload

Design Customization

20 Plugins/Extensions

Multipage Elementor

Design Figma

MAintaine Design

Content Upload

Design With XD

100 Plugins/Extensions

UNEA-7, DAY 2. Inside the UN Environment Assembly press room, three people walked to the podium carrying identical black-and-blue reports. They paused for just a second (long enough for the cameras to click) before the questions started flying.

In the middle was Inger Andersen, head of the UN Environment Programme (UNEP). On her left and right were two of the scientists who spent years writing the report they were holding: the seventh Global Environment Outlook, or GEO-7 for short.

Inger got straight to the point.

“The future is not already written,” she said. “But the window to write a better one is closing fast.”

Sir Bob Watson (yes, the same Bob Watson who’s been warning the world about climate and biodiversity for over 40 years) stood next to her. He’s not one for drama, so when he spoke, everyone listened.

“If we get this right,” he said, “we’re not talking about saving a few billion dollars. We’re talking trillions (every single year) once we fix energy, food, materials, finance, and nature.”

The numbers in GEO-7 are brutal, but they come with a surprisingly hopeful twist.

Right now:

Keep going like this, and things get much worse.

Or we can change course.

The report maps out two realistic ways to do it: one leans hard on new technology, the other on changing how we behave. Either way, the big payoffs start showing up by 2050 (inside the lifetime of most people reading this).

If we make the shift, the world could see at least $20 trillion in annual benefits by 2070, plus millions of lives saved from dirty air, poisoned water, and collapsing ecosystems.

Bob Watson put the choice bluntly: “The cost of doing nothing is way higher than the cost of change. Always has been.”

taking photos, moving between the podium and the rows of journalists. What stayed with me wasn’t the slides or the statistics; it was the mood in the room. These weren’t activists shouting slogans. They were scientists and officials who’ve seen every climate meeting for decades, and they still sounded like they believed we can do this.

Inger Andersen said the quiet part out loud:

“We already have the tools and the agreements. What we’re missing is the political courage to use them.”

That’s it. That’s the whole story of GEO-7.

It’s not a prediction of doom. It’s a menu. Two paths that work, laid out by 287 experts from 82 countries after six years of work. One path keeps heading toward breakdown. The other actually makes us richer, healthier, and keeps the planet livable.

We still get to pick.

Walking out of the conference hall, camera slung over my shoulder, I kept thinking the same thing:

This wasn’t just a report launch.

It felt like the moment the world was handed a map (and asked, very politely but very firmly, to choose the right road before the junction disappears).

The seventh session of the United Nations Environment Assembly (UNEA-7), scheduled for December 8–12 in Nairobi, has not officially begun. But inside the United Nations compound at Gigiri, the negotiations are already underway, long before delegates take their seats for the formal opening.

For the past two days, youth leaders, civil society groups, scientists, and government observers have packed into meeting rooms for the pre-UNEA consultations, a series of stakeholder sessions that traditionally shape the political tone of the main assembly. What unfolded on Day 2 was a reminder that environmental diplomacy is increasingly being driven not just by member states, but by a new generation unwilling to settle for vague promises or soft language.

I was part of these discussions, witnessing the tension, the urgency, and, at times, the exhaustion that defined the day.

This year’s UNEA—the world’s highest environmental policymaking forum—will examine issues ranging from microplastics to wildfires, AI’s environmental footprint to the escalating crisis of water insecurity. But it was the early negotiations around governance, mineral extraction and the circular economy that consumed much of Day 2.

Across the sessions, a single theme emerged: young people want their voices not only heard but written—explicitly—into UNEA’s agenda.

The most tense exchanges of the day centered on mineral resource stewardship. As governments rush to scale up renewable energy systems, demand for lithium, cobalt, copper, and rare earths continues to surge. The question is whether the world can pursue a green transition without repeating the extractive injustices of the past.

Youth delegates argued, NO!

In a session I attended, amendments to the draft text were debated line by line. Youth and Children fought to have the same rights as member states. A suggestion that was fiercely debated. Fiecly contested. This saw major changes in the drafts that kept making it hard overall.

The room pushed back.

Several sessions ran into the evening as participants sacrificed their dinner breaks to reconcile opposing clauses. It was the clearest sign yet of how deeply this issue divides stakeholders—and how hard the youth bloc is prepared to fight.

Another major topic—waste management—sparked its own urgency.

Delegates pressed for a complete shift toward circular economic systems and stronger Extended Producer Responsibility (EPR) policies. The argument was straightforward: without systemic change, global waste costs could reach an estimated $640 billion by 2050.

Text negotiations often spilled into the hallways. During lunch breaks, I watched groups huddle over laptops, adjusting wording that could determine whether producers are merely encouraged or legally obliged to redesign systems that reduce waste.

The line between idealism and feasibility was thin, but the determination to keep circularity on the table was overwhelming.

Perhaps the most emotionally charged theme was youth participation itself.

For years, young people have been invited to international environmental negotiations, but often in symbolic, non-binding roles. This time, they want more.

They pushed for;

Corridor conversations—which often reveal more than the official sessions—were dominated by this topic. Some delegates revisited it even after sessions closed, continuing discussions over coffee and on the walkways outside Conference Room 1.

The energy was unmistakable: youth leaders want UNEA-7 to be the moment their role becomes embedded in environmental governance—not an afterthought.

An unexpected but powerful thread woven through several sessions was the challenge to traditional economic metrics.

Participants urged policymakers to redefine prosperity to include:

The argument was not radical but timely. In an era of escalating climate extremes, many questioned whether GDP alone can meaningfully measure a nation’s success.

By the end of Day 2, the drafting committees—exhausted, hungry, and still debating—had made measurable progress.

Their efforts are feeding directly into two major documents:

Both will be presented to government delegations during UNEA-7 and will influence how negotiations unfold when ministers arrive next week.

The level of commitment was impossible to ignore: delegates skipped meals, revisited stubborn clauses in the corridors, traded ideas during lunch, and returned to the negotiating table late into the evening.

This was not symbolic participation. It was policymaking at its most human—messy, determined, and deeply felt.

If these pre-UNEA sessions are any indication, the formal negotiations beginning December 8 will be contentious, emotionally charged, and unusually youth-driven.

And perhaps that is precisely the point.

In a world facing overlapping environmental crises, the people who will live longest with the consequences are no longer willing to wait quietly outside the room. At UNEA-7, they are not only demanding a seat at the table—they are actively rewriting the agenda. And I will be there to witness it all!

I am available for freelance work. Connect with me via and call in to my account.

Phone: +01234567890 Email: admin@example.com